This comprehensive guide outlines the process of linking your Permanent Account Number (PAN) with Aadhaar, ensuring compliance with the latest regulations. PAN is a unique alphanumeric identification number issued by the Income Tax Department of India, while Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI). PAN is a crucial identifier for financial transactions, tax filings, and other official purposes. Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI), linked to various government schemes, subsidies, and services.

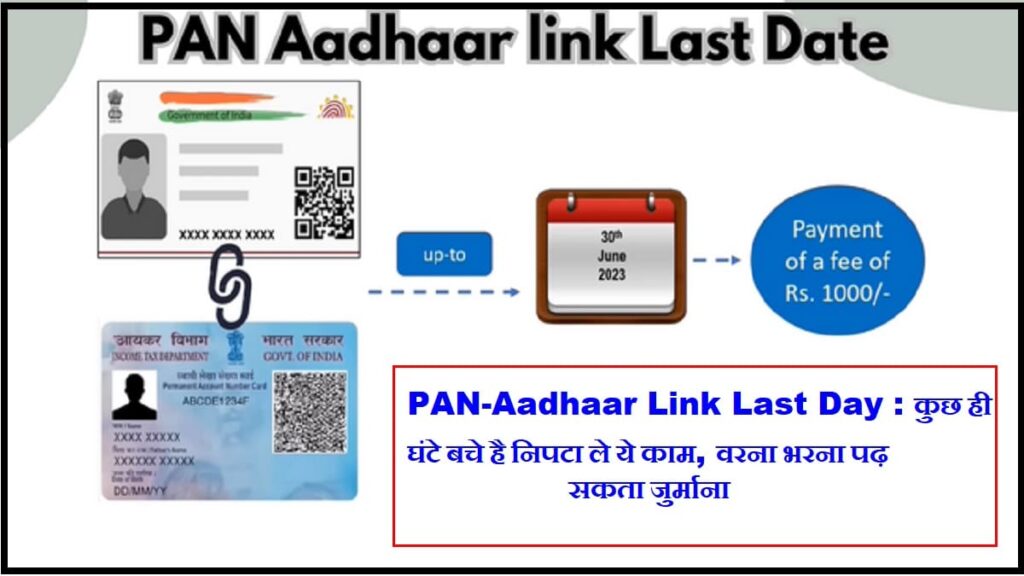

Linking your PAN card with Aadhaar is a mandatory requirement imposed by the Indian government. Failing to link the two before the deadline can result in consequences such as invalidation of PAN or difficulties in financial transactions. Therefore, it is crucial to complete the linking process within the specified timeframe.

To link your PAN card with Aadhaar, follow these simple steps:

- Visit the Official Income Tax e-Filing Website at [www.incometaxindiaefiling.gov.in] and log in using your credentials.

- Access the Link Aadhaar Option and navigate to the “Profile Settings” section.

- Enter PAN and Aadhaar details accurately.

- Verify the details to ensure accuracy.

- Authenticate through OTPC by clicking on the “Link Aadhaar” button and entering an OTP (One-Time Password) on your registered mobile number linked to Aadhaar.

- Confirm the successful linking of PAN with Aadhaar.

The benefits of PAN-Aadhaar linking include simplified income tax filing, elimination of duplicate PANs, and prevention of tax evasion. By positioning this article as an authoritative resource, it helps users access accurate information and complete the PAN-Aadhaar linking process before the deadline.

Your article helped me a lot, is there any more related content? Thanks!